Mobile Home Parks: Discovering the Attraction and How To Add Value

Manufactured home parks remain one of the best multifamily real estate investments in commercial real estate today. The basic concept of a manufactured home and land together form a unique investment property for a number of reasons. This packaging of serviced land and home creates far more worth than the two components individually. In fact, it is within this unique coupling that the ability to create income streams, appreciation and other profit centers occurs. Manufactured homes, which include prefabricated mobile and modular units as well as prefabricated log homes, are customizable from the most basic job site utility offices all the way to elegant, multi-level summer cottages, affixed to concrete basement foundations complete with fine finishings including jacuzzi tubs, vaulted ceilings, carports and decks.

Manufactured home parks or mobile home parks are recognized as one of the best forms of affordable housing. Mobile homes allow low to middle income families, retirees and secondary property owners to build equity in the home they own, irrespective if they own or rent the land. Given that these homes are purchased new or used at a fixed price, it does eliminate much of the consumer construction risk associated with building.

How is demand changing for modular housing? Before the early 1990s, this form of housing was primarily purchased by low to middle income earners and contained very simple design and style. Today, more and more of these homes are purchased by people in all walks of life. First, the significant improvements to the quality of construction and the choice of finishings have increased modular home popularity. Second, as our population ages and real estate decisions are made to accommodate lifestyle, the mobile home has afforded the mature market to sell their larger urban home, purchase a modular house in a park that is maintained for them year round while they flee abroad to travel in their RV.

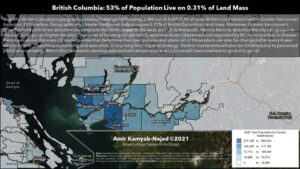

According to a nationwide survey of Canadian attitudes towards recreational property ownership conducted by Angus Reid and commissioned by Royal LePage Real Estate Services released May 31, 2010, an analysis of regional trends in preferred property types noted that 15% of British Columbians would purchase a modular home or RV as a second home or vacation property alternative.

Perhaps one of the reasons why most investors ignore this lucrative asset class is that there seems to be less understanding about mobile home park operations, availability, income potential and the management of them under the Residential Tenancy Act of BC. For this reason, investors remain skeptical and mobile home park investors are comparably fewer and farther between. As land intensive assets, appreciation in the short and long run should be a serious consideration for investment. As cash flow, land intensive investments, lenders are quite comfortable with mobile home parks as solid real estate investments. Mobile home parks are best as a long-term rental property providing the investor with a steady and improving cash flow. They also have the added advantages of equity build up through appreciation andtax savings through depreciation of the improvements and owned homes in the park.

Typically mobile home parks are located in rural and secondary markets and address a housing need of the lower/middle income earners. Demand for these properties remains high in both good and bad economies. Typically, when the economy is up, more entry-level jobs are available, which translates into more people who need affordable housing. In poorer economies, downsizing occurs. People are no longer able to afford their current home, forcing them to find affordable housing alternatives. So why are not more mobile home park community being developed. In the past 30 years in BC less than a handful of parks have been created in the province for a few reasons. First, mobile home parks require larger land tracts which increase up front costs. Servicing of these lots is also expensive and renders the investor out of pocket for most of the costs with no rentals in place. As mobile homes require set up and a large moving expense, absorption, even into the most desirable communities, is slower.

What are the profit centres in owning a mobile home park?

1. Buy right. The same applies for any real estate purchase; the investor makes the most money at the time of purchase. Ideally the investor finds an owner that has managed their park poorly over the years, either out of ignorance or apathy. Once firming the property in any agreement, sometimes with the previous owner carrying some or all of the financing, this knowledgeable mobile home investor makes the wholesale changes necessary to increase net operating income and ultimately the value of the asset.

2. Raise rents. Although limited by the Residential Tenancy Act in terms of how much and how often, it is important that the investor remains current on giving notices of rent increases as appropriate. All too often investors miss the opportunity to increase their rents and stay current with the market rates. This directly affects the value of the park. A $10 per month net rent increase at a valuation using an 7% capitalization rate, can increase the per lot value of $1,714.

3. Fill vacant lots. The rent from vacant pads cannot be recovered. Furthermore, in many cases, a vacant lot is actually costing money for its upkeep. There are many ways to add incentives for potential Tenants, but use caution in offering free or reduced rent, free installation of new skirting, free steps and decks. It is important to maintain a positive relationship with existing Tenants and free incentives to new Tenants can have a negative impact for existing Tenants who pay rent and have loyalty to the mobile home park community. In purchasing a mobile home park, ideally a purchaser wants upside and the ability to manage the park better than his predecessor. With every vacancy filled you will improve the park value.

4. Sell or rent modular homes. Buying new or used mobile homes and setting them up the park for resale or rental can drastically increase the value of the community. As mentioned, each time a vacant space is filled, the value of the park increases. As a community owner, the double advantage exists of profiting from the sale and pad rental on each home sold. The profit of selling these homes would not appear on a rent roll or be reflected in a capitalization rate when valuated the park using an income approach, but are definitely a known profit centre.

Unlike any other real estate investment, if a mobile home becomes outdated or the floor plan no longer appeals to the market, a park owner, at the time the pad is vacated or the lease terminates, can simply remove the mobile home and replace it with a newer home that meets consumer demands and raises the curb appeal of the park. By purchasing used or repossessed mobile homes, the Landlord can make these upgrades very quickly and inexpensively. This of course is impossible to do with a detached home, or apartment.

5. Finance the purchase. In some cases, mobile home park owners realize their potential Tenants do not qualify for bank financing or are unable to pay for the mobile home outright. It is possible for the park owner to finance the purchase, even at higher interest rates, providing yet another profit centre. This also can occur more frequently in smaller communities where major industry, like mining or lumber, can experience sudden job loss and affect the Landlords ability to sell homes and rent pads.

6. Add additional income sources. Does the park have vacant land, unused playground space, or very large lots that can be divided? Consider adding additional lots, mini storage units, or fence off storage for RV’s or boats. In the case of highway frontage, a Landlord may consider placing billboards or selling easements to billboard companies. Consider leasing utilities like Cable TV or Wi-Fi to your Tenants. Additional revenue can also come in other forms of coin operated laundry, vending machines, lawn service, day care service, club house, etc.

7. Increase curb appeal. There are so many opportunities in the category and a read through some of the Landlord best practices is worth the time. Some of the basics include, encouraging residents to clean up their yards and property by offering incentives, contests or assisting in the costs by renting a truck. Hold clean up days on a yearly basis in spring. New and attractive signs can make an impactful difference. Keep road and street lighting in good repair. Common areas like the entrance shrubbery, grass and planters must be kept neat and seasonally appropriate. The playground should be in good repair, fun, and inviting for families and children if that is the target demographic.

8. Standardize the lease. One of the most under utilitized methods of increasing value is to ensure your park operation is using a well constructed, standardized lease. This is an opportunity for a Landlord to create more favorable agreements with new Tenants in areas like the separation of rent and expenses as opposed to a gross lease, best practices in yard maintenance, tenant approval process, fixed lease terms etc. This decreases Landlord risks and increases park value.

9. Utility metering. By installing meters and billing tenants for water, sewer, trash or whatever the utilities are that are controlled or provided by the Landlord, the investor is in effect increasing the bottom line. This is one of the most equitable ways of to pass on expenses to the Tenants as they only pay for what they use. It also becomes apparent to the Tenants where the increases are originating, either from property taxes, utility costs or an increase in rents. Green practices emerge as well in that as meters are installed, master water and sewer bills can be reduced by 30-40% as Tenants become conscious of their utility consumption. Leaky faucets are fixed, toilets no longer run continually; garden hoses are not left running, etc.

10. Stewardship of the Rules & Regulations. By enacting reasonable rules and regulations your community will be regarded as a safe and comfortable community. Problem tenants should be eliminated. The investor should not be concerned about the loss in rent from one or two problem Tenants, consider rather the quality prospects and good Tenants that may not lease or continue to reside in your community.

11. Reduce property taxes. Although not a regular occurrence, property tax reductions are possible. There are firms that specialize in appealing property taxes to have your valuation and taxes reduced.

12. Reduce ongoing expenses. Get multiple insurance quotes, evaluate telephone costs and extras, negotiate with plumbers and electricians to get a lower hourly rate, etc.

13. Rezone the property. Sometimes not the most politically favorable alternative, but mobile home parks that lie in the path of development see very large increases in value over time. Most of mobile home parks are between 15 and 30 acres. Historically, that land becomes so valuable that many are replaced by larger commercial, retail or residential developments. Mobile home parks can produce steady monthly cash flows as the land appreciates.

It is hard to argue about the merit to investing in mobile home parks. Still in doubt? Just ask Jim Clayton of Clayton homes who sold his company and portfolio of mobile home parks in 2003 to Warren Buffet for $1.7 Billion dollars! As there continues to be pressure on affordable housing in BC, mobile home parks will provide one of the best affordable housing alternatives and will continue to be one of the top performing multifamily asset classes.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/XRZEAVNGONAQDMRPUEPJZCNUUY.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/JNP6UM2HLFFONCQPOXLBQYE4QA.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HDIKPH7D5VDKPJOV4P5XC5ASDE.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/Q5MHHEWRTNDVJDRMF34SXJ52Z4.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/XXD7YQ3YYFG5ZEDL5EJK2MYRMU.JPG)